AI-enabled pattern recognition and documentation systems are widely used across industries. Healthcare is using AI to recognize patterns in radiology. Banks use AI-augmented OCR for automatic check deposits at ATMs allowing customers to make deposits without having to visit the bank.

On Tuesday, Fusemachines conducted the second of its three webinar series: Image to Insight: Practical AI for Business with Cee (Carol) Bunevich VP of partnerships at Fusemachines, partner Jim de Vries, founder of Enhance International Group (EIG), and Bülent Uyaniker, Fusemachines PhD consultant and founder of DataSpeckle.

EIG stands to challenge the prevailing management practices by collaborating with companies on turnaround management, corporate restructuring, productivity, and performance improvement for companies and stakeholders.

The webinar covered real-life applications of AI-augmented OCR, from automation to vision to deep learning. The Altman Z-score to analyze financial data and predict bankruptcy using deep learning was also explained.

Here are our takeaways.

Machine learning vs deep learning

Both machine learning and deep learning use algorithms that modify themselves without human intervention to produce the desired output. The key difference between them is the way data is fed to the system. Deep learning has multiple layers and a hierarchy of information. It doesn’t need structured data, and it extracts features itself. Machine learning requires structured data and some occasional human intervention to retrain the algorithm to achieve the desired output.

For instance, both methods identify whether an object is a car but use different paradigmatic approaches to do so. The artificial neural networks in deep learning organize and distribute the data according to characteristics in hierarchical layers. Machine learning requires structured data: labeled objects (cars, buses, buildings, etc.) defining specific features.

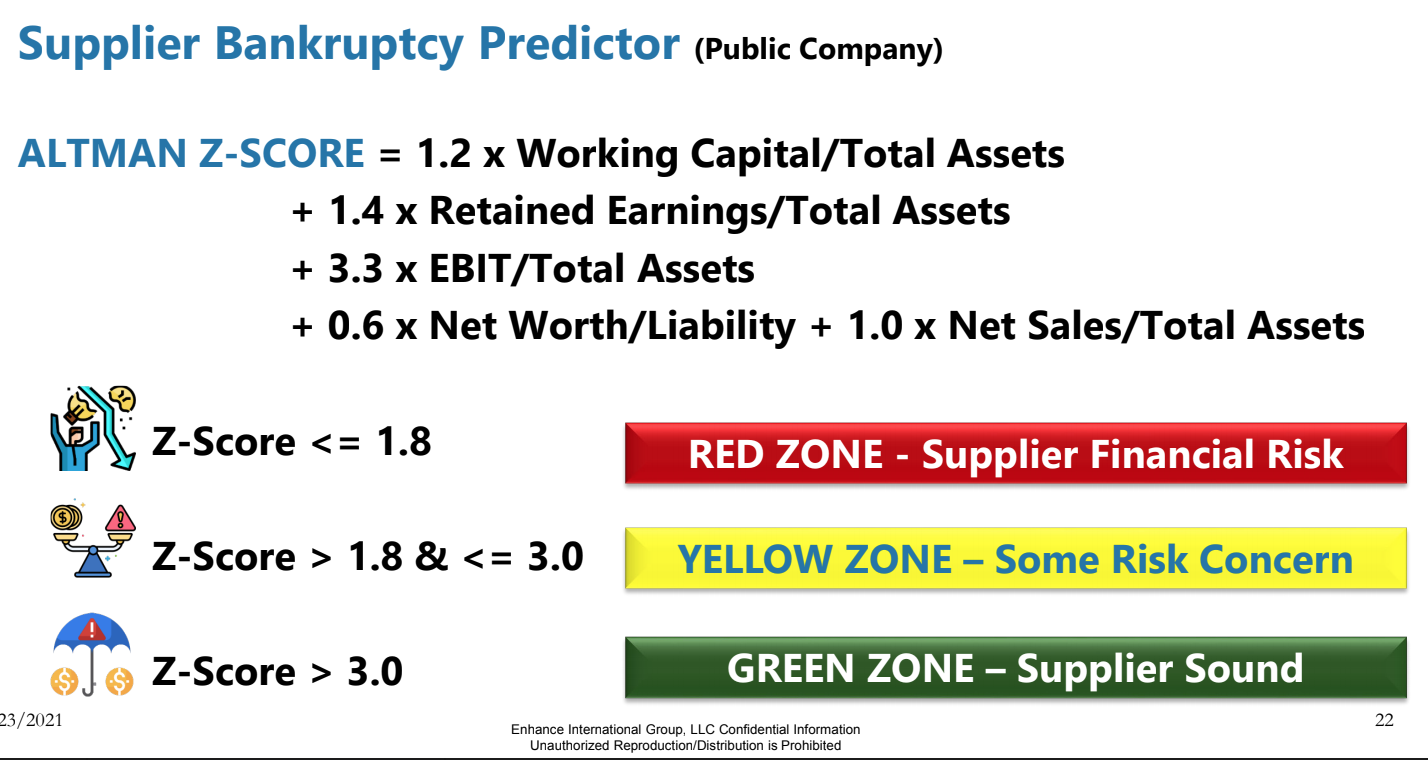

Altman Z-Score

The Altman Z-score is a predictive measurement that indicates financial stability. Its objective is to predict financial health and the likelihood of bankruptcy over the coming two years. It was created in 1968 by American finance professor Edward Altman. Altman Z is one of the many financial calculations that can be explored using deep learning. It is used in the supply chain world to evaluate vendors. The goal is to automate financial data into standardized form.

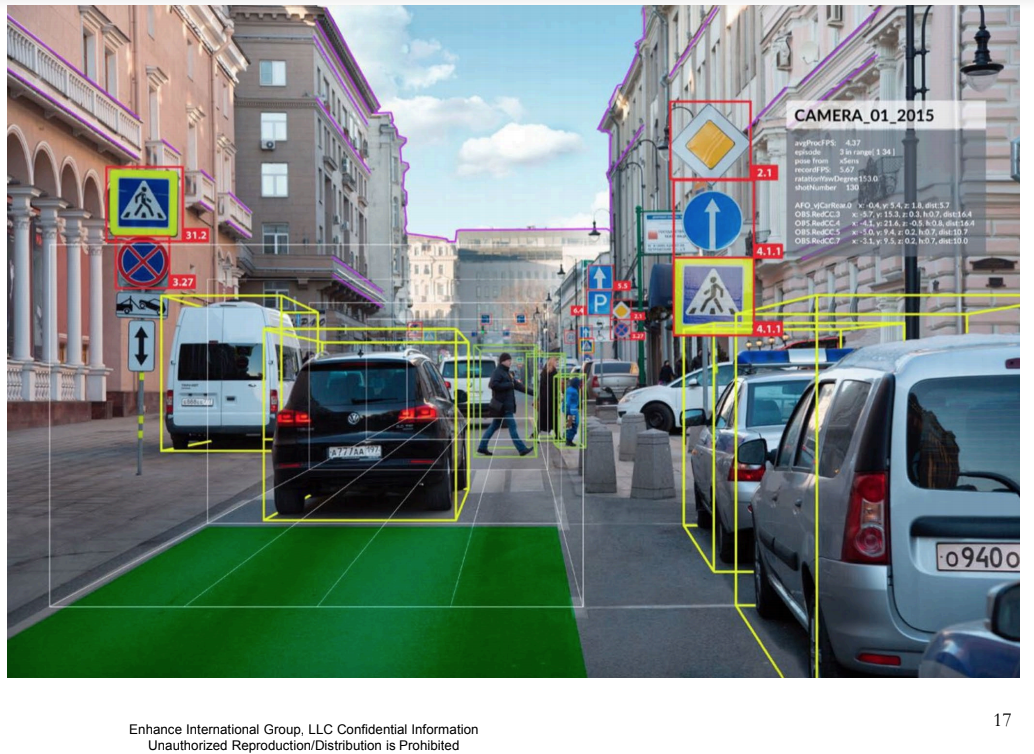

Computer vision applications

Computer vision uses both machine and deep learning algorithms to enable computers to achieve an interpretation of the real visual world using digital images and videos. Early adopters of the technology were finance and banking. Today, we have self-driving cars that use CV to drive autonomously by classifying and detecting objects. The aviation industry has been taking to the skies with autonomous aircrafts while other industries experiment with CV to manufacture self-driving ambulances, trains, and so on.

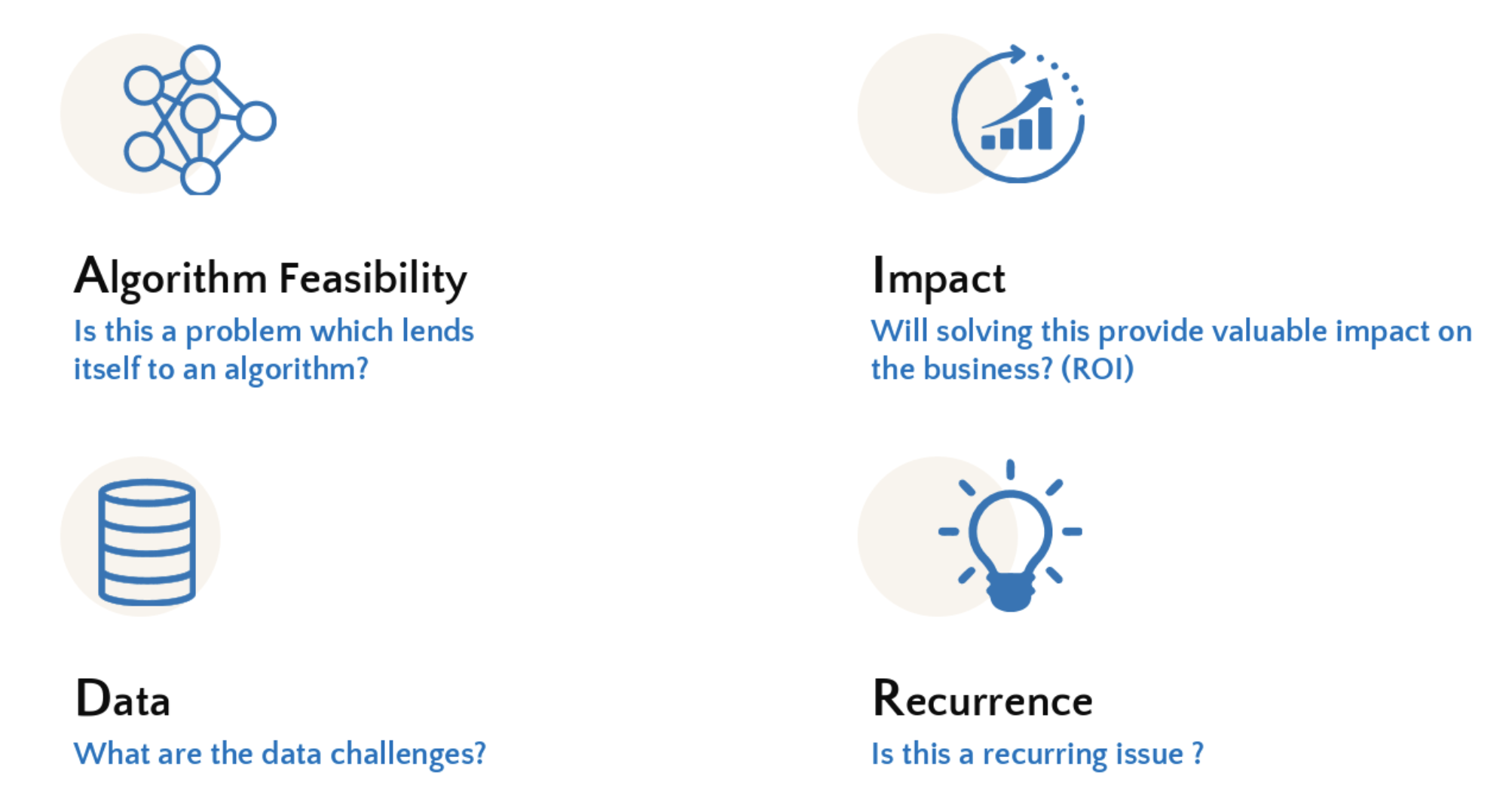

AIDR Scoping Framework

The AIDR framework (A = Algorithm Feasibility, I = Impact, D = Data, and R = Recurrence) is a 4 step framework helping businesses prioritize and determine problems well suited for an AI Solution. Using this framework, one can determine if a project is AI-ready, what kind of ROI to expect, and what it would take to build an AI system to solve their organization’s problem.

- The first thing to consider is whether while this is a problem that lends itself to an AI solution (i.e., determining the viability of the algorithm)

- Next, one needs to understand the impact of the solution by determining whether or not it results in a significant ROI

- The third step is to discover the data challenges. Without a large amount of data, building an AI model is almost impossible

- Lastly, is this a recurring problem? Putting in the time and effort to create an AI solution makes the most sense for recurring problems that generate constant data.

For more information about EIG, click here. To view the webinar, click here.

Look out for our third webinar of the series on Documentation of Human Behavior on April 20 1:00 PM EST. We’ll announce and open free registration on LinkedIn.