FinTech & Financial Services: Practical AI for Business Webinar Takeaways

Artificial intelligence’s applications in financial services are vast, from fraud detection to demand forecasting and more. While there are many perks of AI in finance there are things to consider before jumping in.

Tuesday’s webinar was the 6th in a series of webinars on practical AI for business with Cee (Carol) Bunevich VP of partnerships at Fusemachines, partner Jim de Vries, founder of Enhance International Group (EIG), and Bülent Uyaniker, Fusemachines PhD consultant and founder of DataSpeckle.

EIG stands to challenge prevailing management practices by collaborating with companies on turnaround management, corporate restructuring, productivity, and performance improvement for companies and stakeholders.

The interactive webinar covered how to tackle commonly faced problems, confirming the right data exists or could be created, planning your tech stack, deciding on an algorithm, and finally the practical applications of AI in finance.

Here are our takeaways.

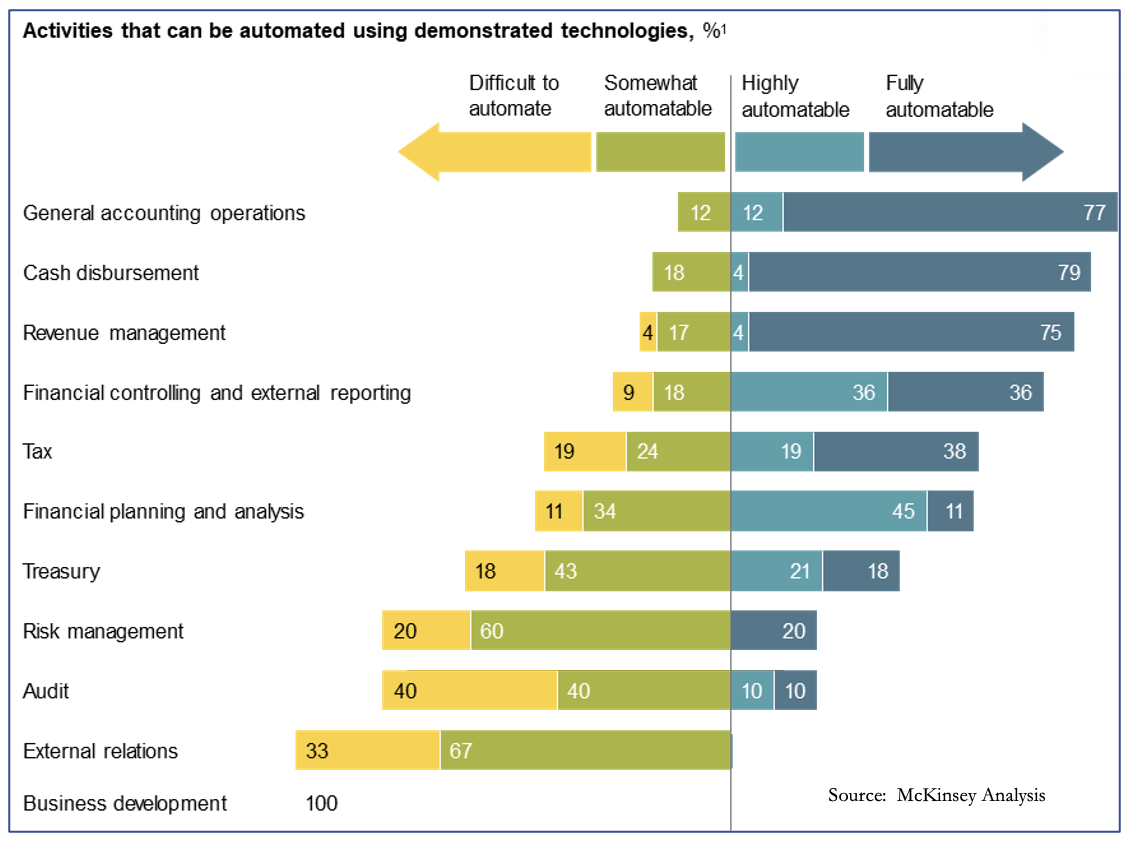

Finance and accounting are very automatable

The webinar started off by showing statistics from McKinsey demonstrating financial activities well suited to automation. According to the research, the top most automatable activities are general accounting operations, cash disbursement, and revenue management. The activities most difficult to automate are business development, external relations, audits, and risk management. In sum, 42% of activities are fully automatable and 19% are mostly automatable, and transactional activities are the most automatable.

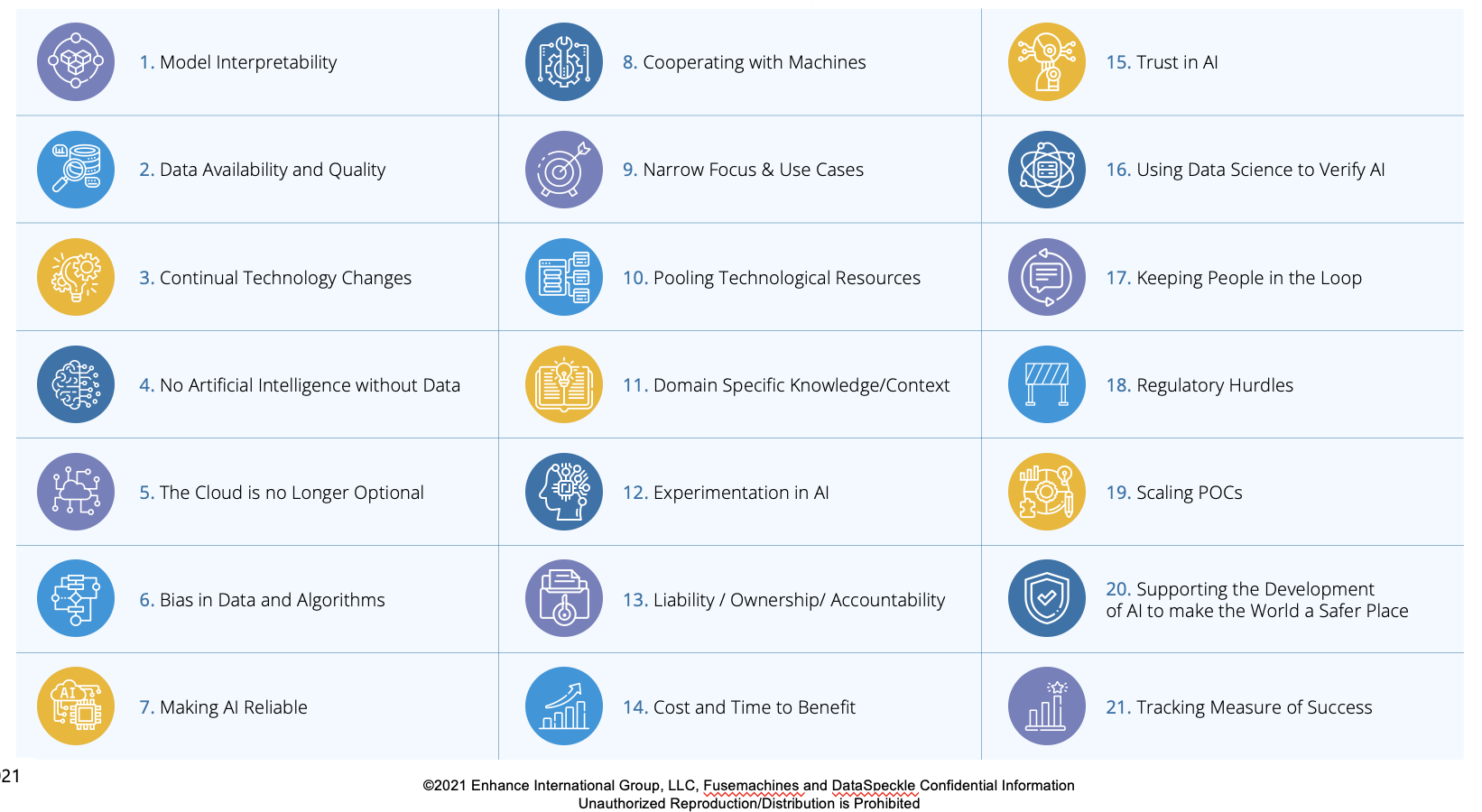

Top AI adoption challenges for finance

As with any technology transformation and especially with AI, there are challenges to overcome. Some of top challenges include model interpretability, the availability and quality of data, keeping up with changes in technology, bias, reliability, and narrow focus and use cases. See the infographic below for more. A central theme of the webinar was that AI cannot exist without data, and companies face many challenges compiling the right data to make an AI effort worth it. This leads us to the next takeaway.

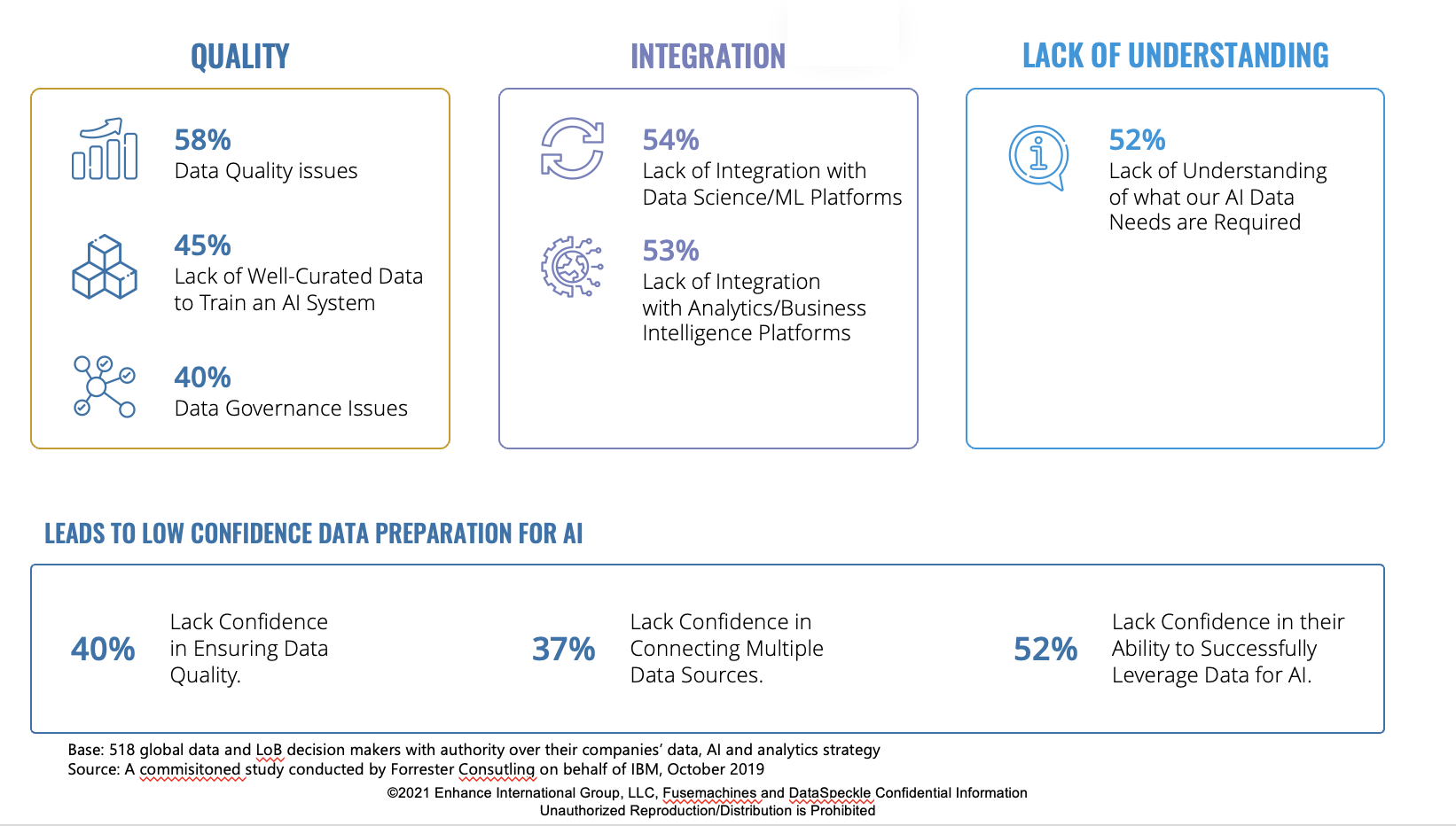

Top data challenges for AI

Overcoming hurdles to AI deployment in banking

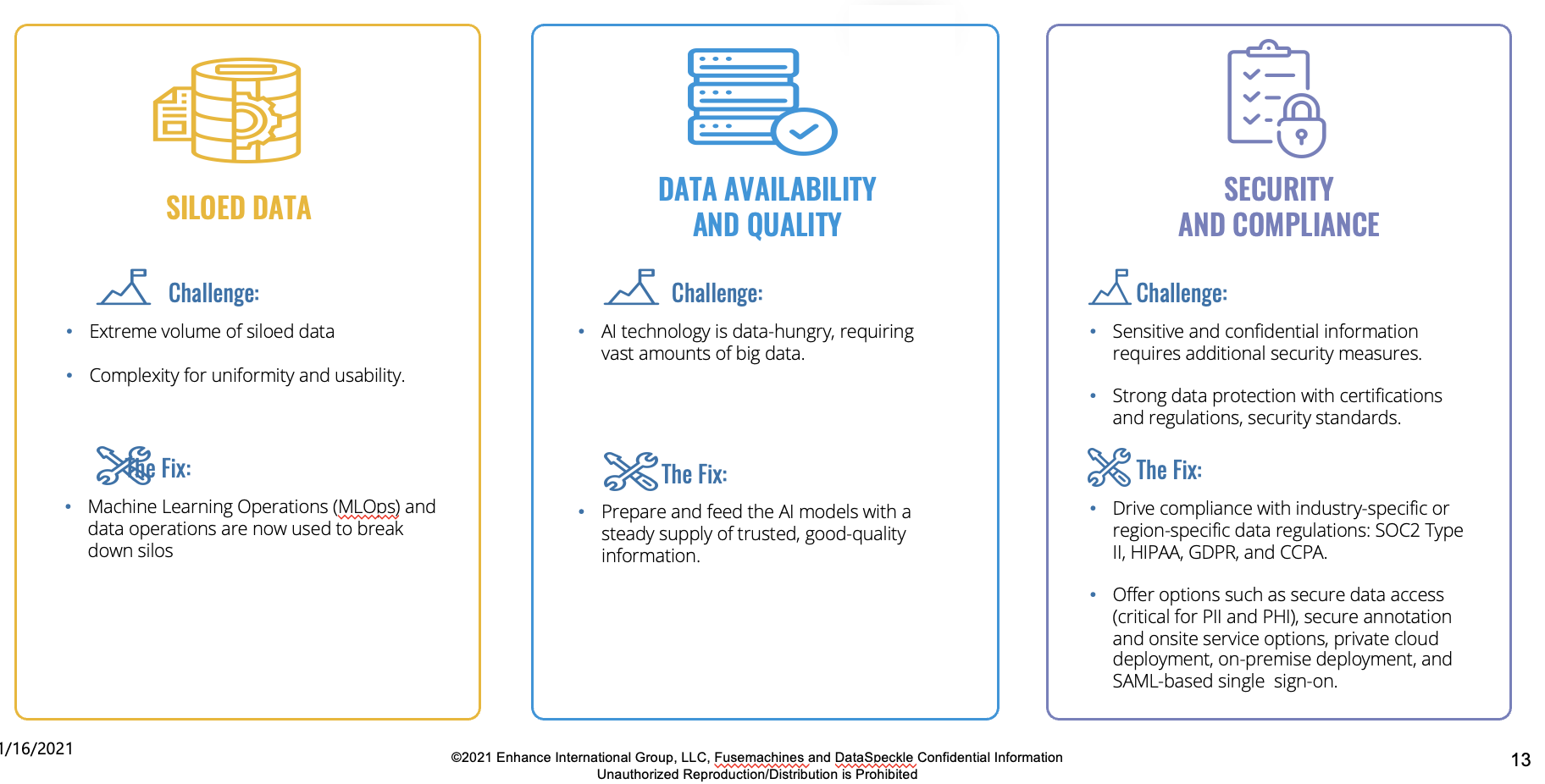

Three key challenges to AI deployment in banking are siloed data, data availability and quality, and security and compliance. Siloed data, data stored in various locations making it hard to access, is a large data related problem in general. Companies often face extreme volumes of siloed data and difficulties in uniformity and usability. The solution to siloed data is machine learning operations and data operations used to break down silos.

Another challenge is data availability and quality. AI requires large amounts of data, and quality data is difficult to come by. The solution is to prepare and feed AI models with a steady supply of trusted, good-quality information.

Another challenge is security and compliance. Privacy is a big concern with the rise of technology and AI, and sensitive and confidential information requires additional security measures, such as strong data protection with certifications and regulations and security standards. A solution to this challenge is to drive compliance with industry-specific or region-specific data regulators: SOC2 Type II, HIPAA, GDPR, and CCPA. Offer options such as secure data access (critical for PII and PHI), secure annotation and onsite service options, private cloud deployment, on-premise deployment, and SAML-based single sign on.

Fusemachines’ AIDR Scoping Framework

The AIDR framework (A = Algorithm Feasibility, I = Impact, D = Data, and R = Recurrence) is a 4 step framework helping businesses prioritize and determine problems well suited for an AI Solution. Using this framework, one can determine if a project is AI-ready, what kind of ROI to expect, and what it would take to build an AI system to solve their organization’s problem.

- The first thing to consider is whether while this is a problem that lends itself to an AI solution (i.e., determining the viability of the algorithm)

- Next, one needs to understand the impact of the solution by determining whether or not it results in a significant ROI

- The third step is to discover the data challenges. Without a large amount of data, building an AI model is almost impossible

- Lastly, is this a recurring problem? Putting in the time and effort to create an AI solution makes the most sense for recurring problems that generate constant data.

For more information about EIG, click here. To view the webinar, click here.